This grey area can lead to. When it comes to working in peoples homes the working arrangements are often casual and wages are paid out in cash.

.png?width=800&name=2017%20W-2%20FORM%20(2).png)

W 2 Reporting Required For Nanny Tax Free Healthcare Benefits

Use The Nanny Tax Companys nanny payroll calculator to calculate nanny pay and withholding.

. Any employee pension payments will. The Nanny Tax Company has moved. Then print the pay stub right from the nanny salary calculator.

Using a calculator that is not current may cost you and your employee when filing tax returns and other reporting documents. Good news though NannyPay offers a low-cost and up-to-date. If you plan to employ your nanny for less.

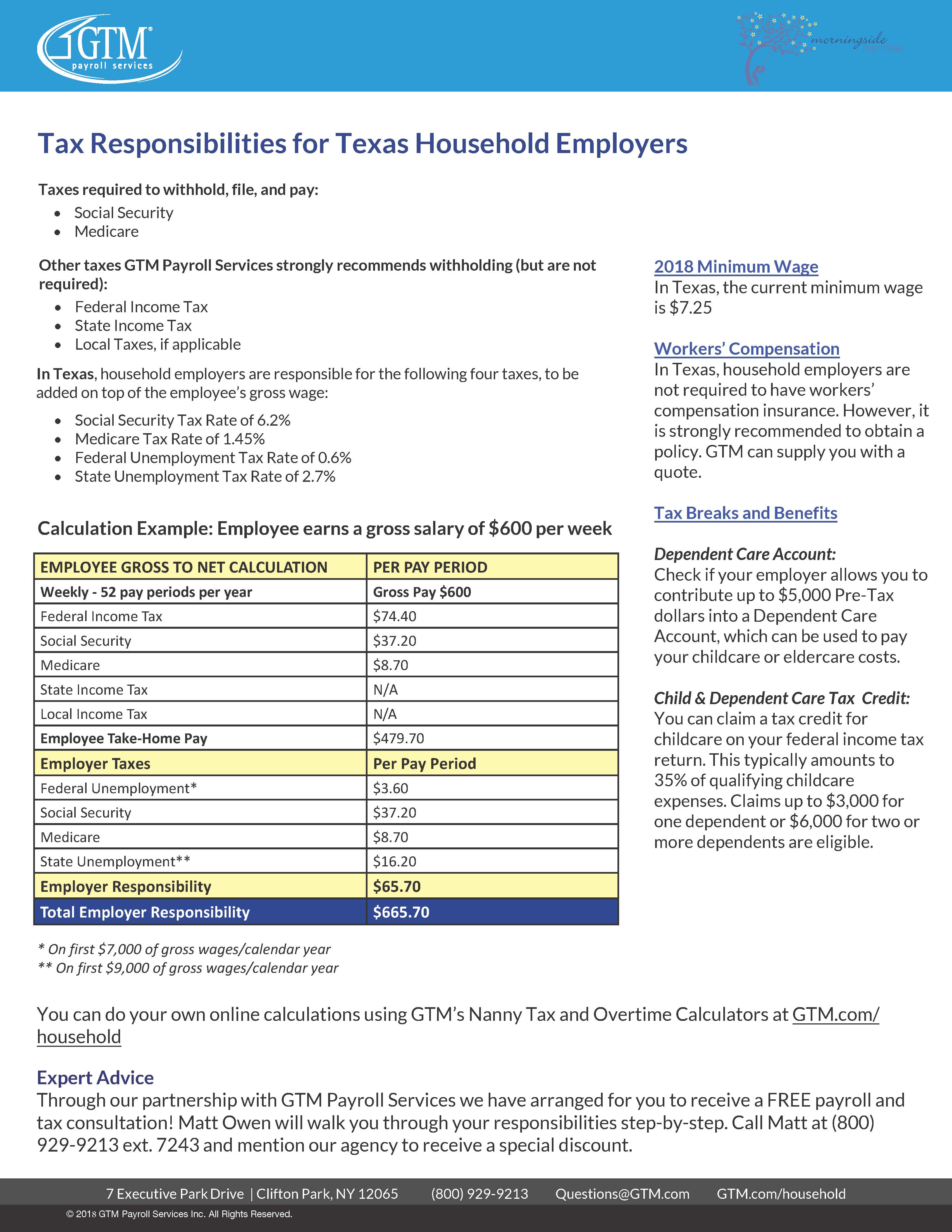

Household employees must be paid at least the highest of the federal state or applicable local minimum. Heres what you need to know about nanny taxes in Texas. Nanny Taxes Youre Responsible for Paying The nanny tax isnt just Social Security and Medicare taxesreferred to as FICA taxesthat are normally split evenly between an.

This calculator allows you to get an idea of how much you will pay and how much your nanny will take home. The Nanny Tax Company has. Form C-20 or C-20F for annual filing.

Texas defers to the FLSA which requires that all domestics excluding companions be paid at no less than the greater of the state or federal. These rates are the default rates for employers in Pennsylvania in a locality that. TEXAS LABOR LAWS Minimum Wage.

Cost Calculator for Nanny Employers. Nanny tax and payroll calculator. Understand your nanny tax and payroll obligations with our nanny tax calculator.

Were here to make life a little easier with this overview of everything you need to know about household employment in the. Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a.

Our new address is 110R South. Researching Texas nanny tax information can be time-consuming. An employer becomes liable to pay unemployment taxes under the Texas Unemployment Compensation Act if the employer pays gross wages of 1000 or more in a calendar quarter.

Our easy-to-use budget calculator will help you estimate nanny taxes and identify potential tax breaks. This is based on the 20212022 tax year using tax code 1257Lx. Easy-to-use nanny tax calculator provides estimate of tax responsibility for a householder employer and tax withholdings for nanny or other domestic worker.

If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H. On a quarterly basis. This calculator assumes that you pay the nanny for the full year and uses this amount as the basis to calculate what you need to pay per month.

Nanny Tax Payroll Calculator Gtm Payroll Services

Full Service Nanny Tax Solution Poppins Payroll

Free Payroll Tax Calculator Paycheck Calculation Fingercheck

Nanny Tax Calculator Gtm Payroll Services Inc

The True Cost To Hire An Employee In Texas Infographic

Common Nanny Tax Questions Poppins Payroll

Household Employment Blog Nanny Tax Information W 2

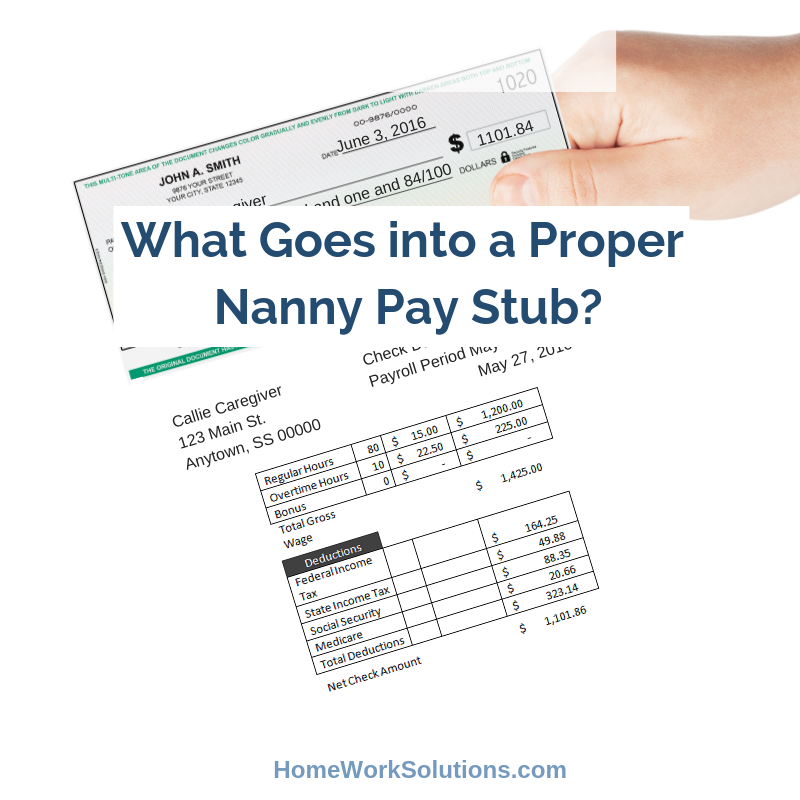

What Goes Into A Proper Nanny Pay Stub

![]()

Texas Nanny Tax Rules Poppins Payroll

Free Gross Up Calculator For Net To Gross Pay Onpay

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Nanny Tax Payroll Calculator Gtm Payroll Services

How Much Should I Hold Out For Taxes On 500 A Week In Texas I M A Nanny For A Family And They Don T Take Taxes Out Of My Pay Quora

The Temporary Nanny And Her Taxes

Nanny Tax Calculator Gtm Payroll Services Inc

Nanny Tax Payroll Calculator Gtm Payroll Services

2018 Nanny Tax Responsibilities